- ‘Disappointing’ Jobs Report Expected To “Revise Up,” WH’s Hassett Says

- Lutnick Says Big Trade Deals To Stay Despite Ongoing Legal Battle

- Fed’s Goolsbee Says He Wants To See CPI Before Making Rate Call

- Trump To Direct Japan’s $550 Bln Investment In US After Deal With Tokyo

- Trump To Reinterpret 1987 Missile Treaty To Sell Heavy Attack Drones Abroad

- Canada To Give Auto Makers A Break On EV Sales Target, Offers Tariff Aid

- Japan To Hike Minimum Pay By Record, Backing BoJ’s Rate Hikes

- Japan PM Ishiba Vows To Draw Up Economic Package in Autumn

- Saudi Arabia Wants OPEC+ To Speed Up Next Oil Supply Boost

- EU Sticks To Planned Russian Oil Exit By 2028, Energy Chief Says

- EU Slaps Google With EUR2.95 Bln Fine Despite Trump Trade Threat

- Tesla Proposes Elon Musk Pay Package Worth Up To $1 Tln

- RFK Jr, HHS To Link Autism To Tylenol Use In Pregnancy And Folate Deficiencies

- Meta Plans To Spend $600 Bln Through 2028 In US, Zuckerberg Says

- Nvidia Partner Hon Hai Sales Rise On Sustained AI Demand

- Zelenskiy: Thousands Of Foreign Troops Discussed As Part Of Security Guarantees

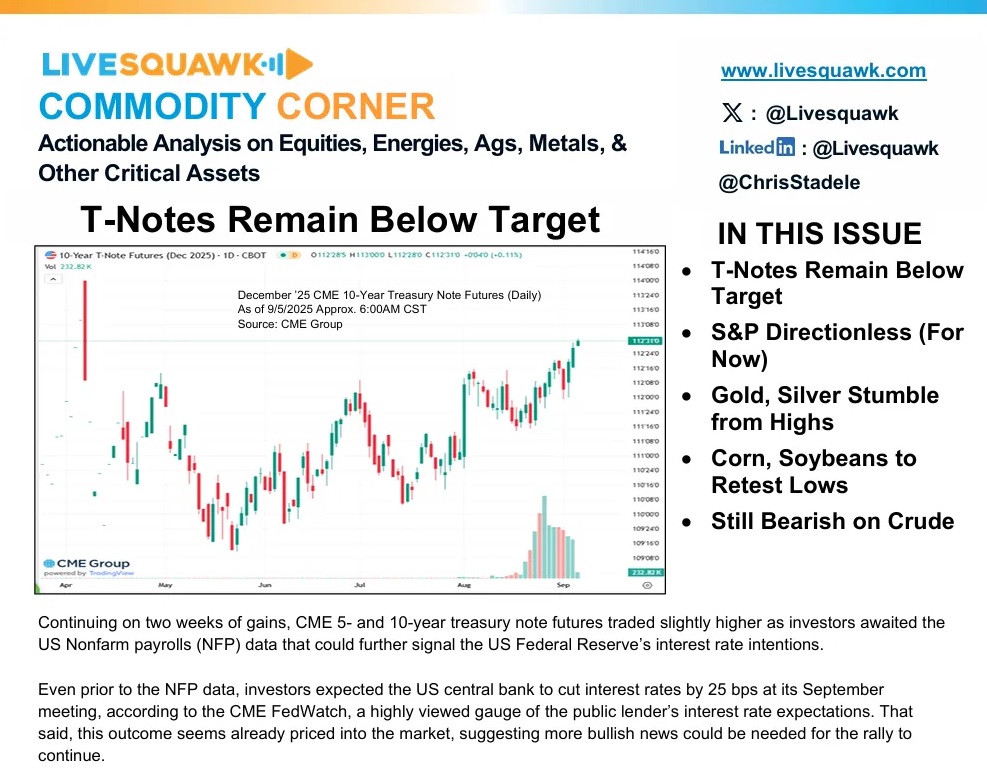

Continuing on two weeks of gains, CME 5- and 10-year treasury note futures traded slightly higher as investors awaited the US Nonfarm payrolls (NFP) data that could further signal the US Federal Reserve’s interest rate intentions.

Even prior to the NFP data, investors expected the US central bank to cut interest rates by 25 bps at its September meeting, according to the CME FedWatch, a highly viewed gauge of the public lender’s interest rate expectations. That said, this outcome seems already priced into the market, suggesting more bullish news could be needed for the rally to continue. (LiveSquawk – Continue Reading)

White House economic advisor Kevin Hassett called Friday’s new jobs report number “a little bit disappointing,” but added, “I expect it’s going to revise up.”

Hassett’s comments on CNBC’s “Squawk on the Street” came shortly after the Bureau of Labor Statistics reported that nonfarm payrolls rose by only 22,000 in August.

That is less than one-third of the 75,000 new jobs expected by economists who were surveyed by Dow Jones ahead of the report. (CNBC – Continue Reading)

The Federal Reserve may implement as many as three rate cuts in 2025 as labor growth slows and political pressure mounts, according to the chief strategist of Europe’s largest asset manager.

“A slower growth pace of the US job market would support the case for two interest rate cuts by the Fed this year, while political pressure would allow for a third one,” Monica Defend, who heads strategy for Amundi SA, said in an interview. (Bloomberg – Continue Reading)

OPEC+ leader Saudi Arabia wants the group to consider reviving more oil production ahead of its scheduled return at the end of next year amid a push to reclaim market share, people familiar with the matter said.

Key alliance members will hold a video conference on Sunday that will consider what to do with a 1.66 million barrels a day tranche of halted supplies, having just fast-tracked the return of a previous layer over the past five months. Brent oil futures fell as much as 2.4%. (Bloomberg – Continue Reading)

As we saw during the Covid pandemic, lab-created experiments can wreak havoc when they escape their confines. Once released, they can’t easily be put back. The “extraordinary” monetary-policy tools unleashed after the 2008 financial crisis have similarly transformed the Federal Reserve’s policy regime, with unpredictable consequences.

The Fed’s new operating model is effectively a gain-of-function monetary policy experiment. Overuse of nonstandard policies, mission creep and institutional bloat threaten the central bank’s independence. The Fed must change course. Its standard tool kit has become too complex to manage, with uncertain theoretical underpinnings. Simple and measurable tools, aimed at a narrow mandate, are the clearest way to deliver better outcomes and safeguard central-bank independence over time. (WSJ – Continue Reading)

Japan will raise its minimum hourly wage by a record 6.3% to ¥1,121 ($7.56), reinforcing the nation’s wage-price cycle and supporting the case for the Bank of Japan to keep hiking rates.

Prefectures nationwide will boost minimum pay by an average of ¥66 an hour in the current fiscal year, the labor ministry said Friday. The increase marked the largest since records began in 1978. The new wage level, which applies to about three million workers, will gradually take effect from October. (Bloomberg – Continue Reading)

- US Change in Nonfarm Payrolls Aug: 22K (est 75K; prev 73K; prevR 79K)

- US NY Fed GDP Nowcast Q3: 2.10% (prev 2.22%)

- Canada Net Change In Employment Aug: -65.5K (est 5.0K; prev -40.8K)

- Canada Ivey PMI SA Aug: 50.1 (prev 55.8)

- Eurozone GDP SA (Q/Q) Q2 T: 0.1% (est 0.1%; prev 0.1%)

- ‘Disappointing’ Jobs Report Expected To ‘Revise Up,’ WH Advisor Hassett Says – CNBC

- Lutnick Says Big Trade Deals To Stay Despite Ongoing Legal Battle – RTRS

- Lutnick Will Meet With Swiss Delegation, But Expects Little - SWI

- Fed’s Goolsbee Says He Wants To See CPI Before Making Rate Call - BBG

- BofA Expects Fed To Deliver Two Cuts This Year After Soft Jobs Report – RTRS

- Amundi Sees Space For Three Fed Rate Cuts By End Of 2025 - BBG

- Standard Chartered: We Now Expect A 50bps Fed Cut In September – FXS

- Trump To Direct Japan’s $550 Bln Investment In US After Deal With Tokyo – FT

- Trump To Reinterpret 1987 Missile Treaty To Sell Heavy Attack Drones Abroad – RTRS

- Trump To Issue EO To Allow Punishments For Countries Wrongfully Detaining Americans – CBS

- US Mortgage Rates See Biggest One-Day Drop In Over A Year - CNBC

- Carney Launches ‘Buy Canada’ Push In Response To Trump Tariffs – FT

- Canada To Give Auto Makers A Break On EV Sales Target, Offers Tariff Aid – RTRS

- UK's Cooper Appointed Foreign Minister, Lammy Named Deputy PM - RTRS

- Japan To Hike Minimum Pay By Record, Backing BoJ’s Rate Hikes - BBG

- Japan PM Ishiba Vows To Draw Up Economic Package in Autumn – Nippon

- Ishiba Faces Hurdles In Realizing Full-Scale Consideration Of Dissolution Of House Of Representatives - Yomiuri

- Dollar Falls Sharply After Jobs Data Misses Expectations – CNBC

- EUR/USD Climbs To Five-Week Tops Around 1.1750 - FXS

- GBP/USD Looks Firm Around 1.3550 On Softer Dollar - FXS

- Canadian Dollar Underperforms G10 Currencies As Job Data Fuels Rate Cut Bets - RTRS

- SEC And CFTC Explore Ways To Bring Perpetual Contracts Onshore – CB

- Trump-Linked Token’s Debut Sees Rift With Billionaire Backer Sun – BBGL

- Front Month Nymex Crude Fell 3.34% This Week To Settle At $61.87 – Morningstar

- Saudi Arabia Wants OPEC+ To Speed Up Next Oil Supply Boost – BBG

- EU Sticks To Planned Russian Oil Exit By 2028, Energy Chief Says – RTRS

- Gold Hits Fresh Record High After Soft US Jobs Data – CNBC

- China Issues Anti-Dumping Ruling On European Pork, Charges Deposits – SCMP

- US Stocks Brush Record Highs As Weak Jobs Data Fuel Rate Cut Bets – RTRS

- Europe Stocks Decline As Investors Assess Weaker-Than-Expected NFP – CNBC

- EU Slaps Google With EUR2.95 Bln Fine Despite Trump Trade Threat – POLITICO

- RFK Jr, HHS To Link Autism To Tylenol Use In Pregnancy And Folate Deficiencies - WSJ

- Kenvue Stock Drops 10% On RFK Jr. Tylenol Report – CNBC

- Tesla Proposes Elon Musk Pay Package Worth Up To $1 Tln - TheInformation

- Meta Plans To Spend $600 Bln Through 2028 In US, Zuckerberg Says - TheInformation

- Halliburton Reduces Workforce As Oil Activity Slumps, Sources Say – Yahoo

- Trump Weighs Blocking US Tech Firms From Outsourcing Jobs To India – X

- Thyssenkrupp Steel Workers Approve Restructuring Plan, Await Financing - RTRS

- Portugal Unveils Conditions For TAP Sale, Including Growth Plan – BBG

- BBVA Set To Launch EUR14.9 Bln Hostile Bid For Sabadell On Monday – RTRS

- EDF Is Said To Consider Relisting Italian Unit Edison In Milan – BBG

- Nvidia Partner Hon Hai Sales Rise On Sustained AI Demand - BBG

- Zelenskiy: Thousands Of Foreign Troops Discussed As Part Of Security Guarantees - Devdiscourse

- US Could Take Lead Watching Ukraine Buffer Zone If Peace Deal With Russia Comes Together – NBC

- Trump Grows Pessimistic About The Prospect Of Ending The Russia-Ukraine War - NBC

- Second Round Of Putin-Trump Talks Possible In Near Future: Kremlin – Xinhua

- Ukraine's Allies Are Preparing Next Wave Of Russia Sanctions, Says Carney – RTRS