- SCOTUS Sets Tuesday For Next Opinions With Tariff Ruling Pending

- WH’s Hassett: Can Reimpose 10% Levy If SCOTUS Strikes Down Tariffs

- Trump Floats New Tariffs In Push To Acquire Greenland

- Trump Suggests New Hesitance Over Hassett For Fed Chair

- Fed’s Bowman Sees Risks To Job Market, Says 'Should Be Ready' To Cut

- Ontario’s Doug Ford Slams Canada-China Trade Deal As Threat To Auto Jobs

- BoE's Bailey Says Weak Growth Risks Financial Instability

- Japan Protests Against Chinese Resource Development In East China Sea

- State Street Profit Falls As Expenses Jump

- PNC Profit Jumps On Dealmaking Windfall, Interest Income Boost

- Samsung To Lift DRAM Output 5% In 2026 As Supply Tightness Persists

- Tesla Gets 5-Week Extension In US Probe Of FSD Traffic Violations

- Bayer Gets Supreme Court Hearing In Challenge To Roundup Suits

- Ukrainian Team Heading To US For Security Guarantee Talks, Zelenskiy Says

- UK Splits With France And Italy Over Putin Talks

- EU Executive Weighs Idea Of Quick, But Limited Membership For Ukraine

- Trump And Netanyahu Discussed Iran In Second Phone Call

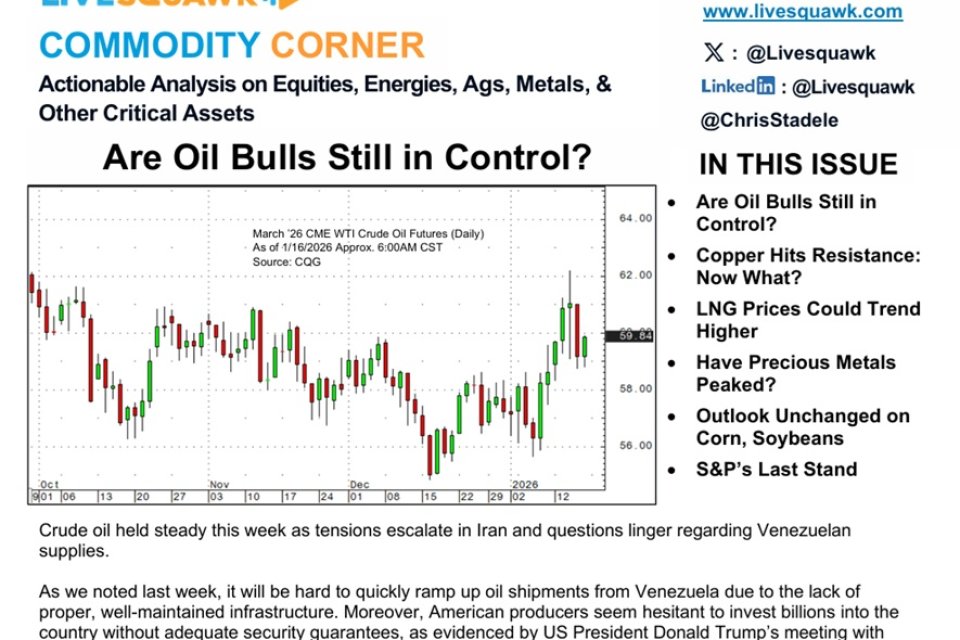

Crude oil held steady this week as tensions escalate in Iran and questions linger regarding Venezuelan supplies.

As we noted last week, it will be hard to quickly ramp up oil shipments from Venezuela due to the lack of proper, well-maintained infrastructure. Moreover, American producers seem hesitant to invest billions into the country without adequate security guarantees, as evidenced by US President Donald Trump’s meeting with American oil executives that yielded little results. Also, Venezuelan crude oil is poorer quality than US grades, fuelling concerns over marketability. (LiveSquawk - Continue Reading)

President Donald Trump said Friday he may impose tariffs on countries “if they don’t go along with Greenland.”

“We need Greenland for national security. So I may do that,” Trump said at the White House.

The comments show Trump, whose push to acquire Greenland for the U.S. has grown increasingly aggressive in recent months, turning to one of his favorite tools for leveraging power over foreign nations.

The White House did not immediately respond to CNBC’s request for additional information on Trump’s remarks. (CNBC – Continue Reading)

White House economic advisor Kevin Hassett said Friday that large U.S. banks could voluntarily provide credit cards to underserved Americans as a means to address President Donald Trump’s affordability push.

A week ago, Trump called for banks to cap credit card interest rates at 10%, an idea that has been roundly rejected by industry executives and their lobbyists this week.

Now, Hassett, who is director of the National Economic Council, is floating a different plan, this one more narrowly focused on consumers who don’t have credit access but have the income to justify credit lines. (CNBC – Continue Reading)

China’s artificial intelligence models may be just “a matter of months” behind U.S. and Western capabilities, Demis Hassabis, the CEO of Google DeepMind told CNBC.

The assessment from the head of one of the world’s leading AI labs and a key driver behind Google’s Gemini assistant, runs counter to views that have suggested China remains far behind.

Speaking on CNBC’s new podcast, The Tech Download, which launched on Friday, Hassabis said Chinese AI models are closer to U.S. and Western capabilities “than maybe we thought one or two years ago.”

“Maybe they’re only a matter of months behind at this point,” Hassabis told The Tech Download. (CNBC – Continue Reading)

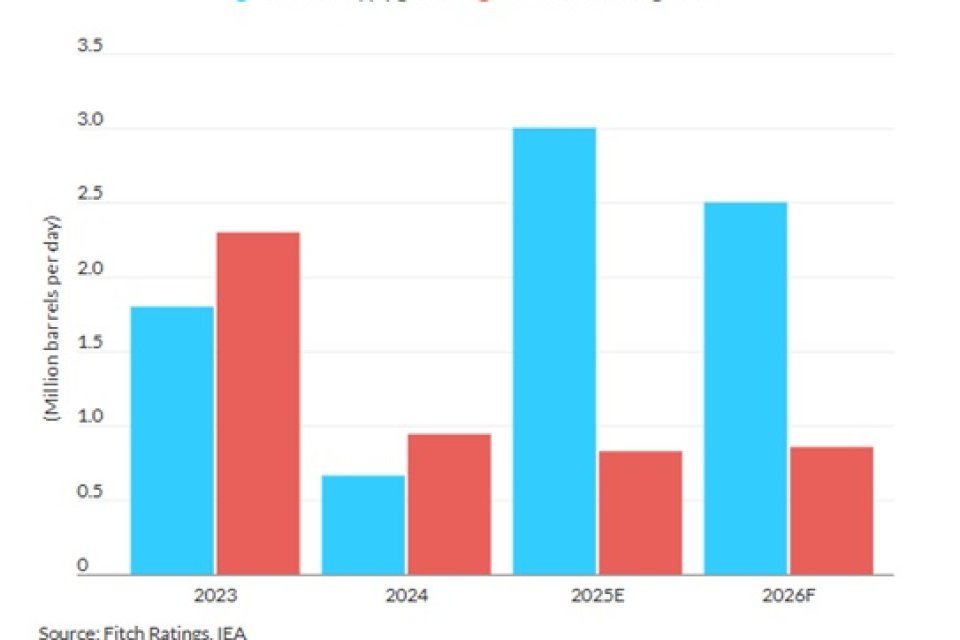

The geopolitical oil risk premium is likely to remain capped due to global market oversupply, despite increased oil-price volatility, Fitch Ratings says. Any possible supply disruptions in Iran can be absorbed by an oversupplied market. Potential short-term supply increases from Venezuela are likely to be small, while a more material rise in the long term would be quite challenging. OPEC’s future strategic stance on volume versus value will be important in shaping the oil market.

Our Brent price assumption for 2026 is USD63/bbl, while our ratings for oil and gas companies focus on credit metrics based on our mid-cycle price of USD60/bbl.

The global oil market will remain oversupplied in 2026. We estimate a supply increase of 3 million barrels per day (MMbpd) in 2025 and forecast a further increase of 2.5MMbpd in 2026, with demand growing by only about 0.8MMbpd each year. (Fitch – Continue Reading)

- US industrial Production (M/M) Dec: 0.4% (est 0.1%; prev 0.2%; prev R 0.4%)

- US NAHB Housing Market Index Jan: 37 (est 40; prev 39)

- US NY Fed Services Business Activity Jan: -16.1 (prev -20.0)

- US NY Fed GDP Nowcast Q4: 2.71% (prev 2.62%)

- Canada Int’l Securities Transactions (CAD) Nov: 16.33B (prev 46.62B)

- Canada Housing Starts (M/M) Dec: 282.4K (est 260.0K; prev 254.1K)

- Trump Floats New Tariffs In Push To Acquire Greenland – CNBC

- WH’s Hassett: Trump Can Reimpose 10% Levy If SCOTUS Strikes Down Tariffs – WSJ

- Trump Suggests New Hesitance Over Hassett For Fed Chair - POLITICO

- WH’s Hassett Plays Down Probe Of Fed Chair Powell – RTRS

- Fed’s Bowman Sees Risks To Job Market, Says Fed 'Should Be Ready' To Cut - Yahoo

- Carney Opens Canada To Chinese EVs, China Cuts Canola Tariffs – POLITICO

- Ontario’s Doug Ford Slams Canada-China Trade Deal As Threat To Auto Jobs – BBG

- US Envoy Says Deal On Greenland 'Should And Will Be Made' – Guardian

- Baltic Nations Make Joint Push To Secure ECB Vice Presidency – BBG

- BoE's Bailey Hits Out At Populism As Trump Interferes In US Fed – Guardian

- BoE's Bailey Says Weak Growth Risks Financial Instability - Yahoo

- Japan Protests Against Chinese Resource Development In East China Sea - RTRS

- Japan’s Finance Minister Issues Fresh Verbal Warning As Yen Falters – WSJ

- Tsy Yields Move Higher As Investors Weigh The State Of US Economy – CNBC

- FedEx Signs Multiple Financing Agreements With Major Lenders - TV

- Yen Strengthens After Japan Warns Of Possible Intervention – CNBC

- EUR/USD Turns Negative Around 1.1600 - FXS

- RBC: Expect EUR/USD To Appreciate 3% In 2026 To 1.20 And 3.0% In 2027 To 1.24 – eFX

- Global Oil Oversupply Can Offset Output Uncertainty In Iran, Venezuela – Fitch

- European Gas Price Jumps On Cold Snap, Tight Inventories - WSJ

- China, Canada To Boost Cooperation In Oil, Gas Exploration – RTRS

- US Accuses EU Of Seeking Cheese ‘Monopoly’ In South America – FT

- State Street Profit Falls As Expenses Jump - WSJ

- PNC Financial Profit Jumps On Dealmaking Windfall, Interest Income Boost – RTRS

- Stocks Waver On Wall Street And Remain Near Records – Yahoo

- Europe Finishes Lower As Greenland Remains In Focus; Gold & Silver Dip - CNBC

- Samsung To Lift DRAM Output 5% In 2026 As Supply Tightness Persists - DigiTimes

- Intel Extends Comeback As Investors Bet On Foundry Growth – BBG

- Tesla Gets 5-Week Extension In US Probe Of FSD Traffic Violations – RTRS

- JPMorgan Forms New Team To Get In On The Boom In Private Markets – WSJ

- Beyond Meat Tests Protein Beverages In Bid For Much-Needed Growth – WSJ

- Bayer Gets Supreme Court Hearing In Challenge To Roundup Suits - BBG

- Airbus' Helicopters Unit Wins Drone Contract From French Navy – RTRS

- Porsche Sales Slump Most In 16 Years On Poor China Demand – BBG

- UK Ministers Draw Up Options For Ban On Social Media For Children – FT

- Ukrainian Team Heading To US For Security Guarantee Talks, Zelenskiy Says – RTRS

- Russia Hails Apparent Desire Of Some EU States To Resume Dialogue – RTRS

- UK Splits With France And Italy Over Putin Talks – POLITICO

- EU Executive Weighs Idea Of Quick, But Limited Membership For Ukraine – RTRS

- Trump And Netanyahu Discussed Iran In Second Phone Call - Axios

- Iran's Exiled Crown Prince Implores Trump To Strike Regime – Axios

- Mossad Director Visits US For Iran Consultations – Axios

- US Floats Expanding Gaza ‘Board Of Peace’ To Other Global Hotspots – FT

- CIA Director Meets With Venezuela’s Interim President in Caracas – NYT