- US Consumer Sentiment Falls Toward Record-Low Levels

- NYFed Infl. Expectations. Fall; Job Market Expectations Mixed

- Republicans Reject Democrat Shutdown Offer

- Senate Considers Revised Plan To End Government Shutdown

- Democrats Set To Block New GOP Proposal To End Shutdown

- WH Advisor: Impact Of Govt Shutdown Far Worse Than Expected

- Miran: Stablecoin Adoption May Pressure Rates Downward

- Jefferson Says Fed Should Proceed Slowly As It Nears Neutral

- Williams: Fed May Soon Need To Expand B/Sh For Liquidity Needs

- Europe Should Mull China Action If Situation Worsens, Nagel Says

- ECB’s Elderson Says Some Downside Growth Risks Have Eased

- Labour: Income Tax Rise In Manifesto’s ‘Spirit’ If Offset By NI Cut

- Muni Market Sets Record As 2025 Bond Sales Eclipse $500B

- Banks Line Up $18B Loan For Oracle-Tied NM Data Center

- KKR Credit Fuels Best Fundraising In Four Years As Profits Rise

- Dutch PM Schoof Says China to Resume Nexperia Chip Exports

- Disney, YouTube TV Remain In Talks To Restore ABC And ESPN

- Siemens Said To Favor Direct Spinoff Of Healthineers Stake

- US Backs EU Using Russian Assets To Support Ukraine

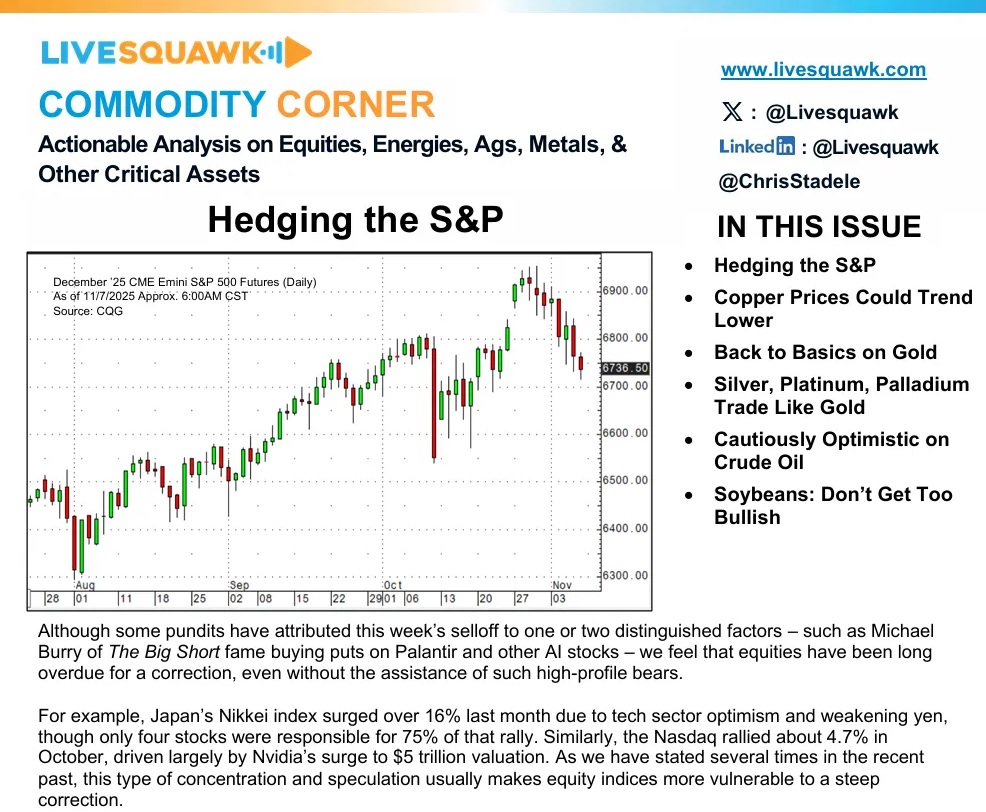

Although some pundits have attributed this week’s selloff to one or two distinguished factors – such as Michael Burry of The Big Short fame buying puts on Palantir and other AI stocks – we feel that equities have been long overdue for a correction, even without the assistance of such high-profile bears.

For example, Japan’s Nikkei index surged over 16% last month due to tech sector optimism and weakening yen, though only four stocks were responsible for 75% of that rally. Similarly, the Nasdaq rallied about 4.7% in October, driven largely by Nvidia’s surge to $5 trillion valuation. As we have stated several times in the recent past, this type of concentration and speculation usually makes equity indices more vulnerable to a steep correction. (LiveSquawk – Continue Reading)

WASHINGTON—Senate Majority Leader John Thune (R., S.D.) told Senate Republicans Thursday that they should expect to vote on a new proposal Friday aiming to end the government shutdown, according to people familiar with the plan, in an attempt by GOP leaders to build momentum toward a deal.

Democrats, however, indicated they weren’t sold on the emerging package, with some saying they would need their core demand of extending Affordable Care Act subsidies to be part of any legislation.

The plan to vote on a revised proposal comes as the impact of the shutdown continues to grow. Government workers have gone without pay for weeks, and low-income families are seeing cuts in food aid and other assistance programs. On Thursday, airlines scrambled to review flight plans after federal officials said they would reduce commercial air traffic starting Friday in response to the government shutdown.

It appears that the U.S. job market continued its long, gradual slowing in October, but did not make a clear break for the worse (or for the better).

The big picture: We're getting a labor market that is distinctly less favorable for job seekers, but it's not the kind of full-on rout you see when a recession is imminent.

That's the cumulative implication of data released by various private firms, Federal Reserve banks and state government agencies shedding light on the October employment situation.

With the longest government shutdown on record, now in its 38th day, economy watchers are left with artisanal economic data, which currently offers a relatively consistent picture.

This week’s equity market wobble, which saw a retreat in U.S. artificial intelligence-related stocks amid ongoing concerns over stretched valuations, has thrust contagion fears into the spotlight for global investors.

Goldman Sachs CEO David Solomon warned this week of a “likely” 10-20% drawdown in equity markets at some point within the next two years, while the International Monetary Fund and the Bank of England have both sounded the alarm bells.

Bank of England Governor Andrew Bailey highlighted the possibilities of an AI bubble in an interview with CNBC on Thursday, noting that the “very positive productivity contribution” from technology companies could be offset by uncertainty around future earning streams in the sector.

“We have to be very alert to these risks,” Bailey said. (CNBC – Continue Reading)

JPMorgan, a leading bank in the United States, recently revealed that it holds 5.3 million shares of the BlackRock Bitcoin ETF, also known as IBIT. This investment is valued at approximately $343 million as of September 30. Notably, this position reflects a significant increase of 64% since June. This move underscores the rising trend of institutional adoption of cryptocurrency, particularly through regulated investment vehicles like ETFs.

In recent years, traditional financial institutions have increasingly turned to cryptocurrency investments. By offering familiar regulatory frameworks, ETFs provide a pathway for these institutions to gain exposure to cryptocurrencies without the complexities associated with direct ownership. This change resonates with both seasoned investors and those new to the cryptocurrency market.

- US NY Fed GDP Nowcast Q3: 2.31% (prev 2.35%)

- Canada Net Change In Employment Oct: 66.6K (est -5.0K; prev 60.4K)

- China BoP Current Account Balance (USD) Q3 P: 195.6B (prev 128.7B)

- Mexico CPI (Y/Y) Oct: 3.57% (est 3.56%; prev 3.76%)

- US Consumer Sentiment Falls Toward Record-Low Levels - WSJ

- Inflation Expectations Fall; Job Market Expectations Mixed - NY Fed

- Senate Considers Revised Plan To End Government Shutdown – WSJ

- Republicans Reject Democrat Shutdown Offer - BBG

- Trump Admin. Asks For Pause On Order To Fully Fund SNAP - NBC

- WH Advisor: Impact Of US Govt Shutdown Far Worse Than Expected – RTRS

- Thune: I'm Willing To Give Democrats All They Want After Reopening – IL

- Democrats Set To Block New GOP Proposal To End Shutdown - WSJ

- Republicans Quietly Optimistic About Fix For ACA Tax Credits - Axios

- Trump Want To Abolish The Filibuster; GOP Senators Say No – WaPo

- Miran: Stablecoin Adoption Could Put Downward Pressure On Rates - MSN

- Jefferson Says Fed Should Proceed Slowly As It Nears Neutral - BBG

- Williams: Fed May Soon Need To Expand B/Sh For Liquidity Needs - RTRS

- BlackRock’s Rieder Sees Soft Jobs Market, Wants Fed Rate At 3% - BBG

- US Army To Buy 1 Mln Drones, In Major Acquisition Ramp-Up – RTRS

- Europe Should Mull China Action If Situation Worsens, Nagel Says – BBG

- ECB’s Elderson Says Some Downside Growth Risks Have Eased – BBG

- Major Brokerages Expect BoE To Cut Rates In December – RTRS

- Labour Figs: Income Tax Rise In Manifesto’s ‘Spirit’ If Offset By NI Cut - FT

- Korean Export Slowdown To Constrain Economic Recovery – Fitch

- S Korea Seeks US Fuel For Domestically Built NP Submarine – RTRS

- US Treasuries Stall As Conflicting Jobs Data Cloud Fed Outlook - BBG

- Muni Market Sets Record As 2025 Bond Sales Eclipse $500B - BBG

- Banks Line Up $18B Loan For Oracle-Tied NM Data Center - BBG

- Morgan Stanley, MUFG See Dollar Drop Once US Key Data Void Ends – BBG

- PIMCO Urges Milei To Let The Peso Float While ‘Times Are Good’ - BBG

- JPMorgan Predicts $170K BTC Within 6 Months - CN

- XRP Bears Tighten Grip As Retail Activity Slows - FXS

- Copper’s Tariff Bet Is Back As Traders Bid For US Supplies - BLaw

- China Suspends Export Controls On Rare Earths – Investing

- KKR Credit Fuels Best Fundraising In Four Years As Profits Rise - BBG

- Constellation Energy Misses Q3 Estimates, Narrows 2025 Forecast – RTRS

- Duke Energy Q3 Profit Beats Estimates On Higher Rates, Volumes – RTRS

- Chips Held Hostage In Trade War Start Flowing Again – WSJ

- Apple Music Risks Losing The Next Generation Of Listeners - BBG

- Bezos Defeats Amazon Investor Case Targeting Musk Space Feud - BLaw

- Disney, YouTube TV Remain In Talks To Restore ABC And ESPN - MSN

- Hegseth Demands Companies Speed Weapons Dev Or Fade Away - BBG

- Dutch Ready To Drop Nexperia Control If Chip Supply Resumes – BBG

- Dutch PM Schoof Says China to Resume Nexperia Chip Exports - BBG

- AI Valuation Fears Grip Investors, Tech Bubble Concerns Grow – CNBC

- State Street Bringing $1.7T ETFs to Retirement Market – CNBC

- Senate Democrats Want Fiserv To Detail Trump Official’s Tenure – WSJ

- Siemens Said To Favor Direct Spinoff Of Healthineers Stake - BBG

- Germany Mulls Expanding Order For Submarine-Hunting Planes - BBG