- OPEC+ Set For Another Oil Hike As Saudi And Russia Debate Size

- Senate Fails To Advance Funding Bill, Shutdown Likely To Extend Into Next Week

- Trump Considering Significant Tariff Relief For US Vehicle Production

- Fed’s Miran Says He’d Adjust Inflation View If Rents Turn Higher

- Fed’s Goolsbee ‘A Little Wary’ About Cutting Rates Too Quickly

- Fed's Williams Says Central Banks Must Prepare For The Unexpected

- Fed’s Jefferson Again Cautions On Risks To Inflation, Jobs Goals

- Canada PM Carney To Meet Trump In Washington On Tuesday

- ECB’s Lagarde Says ECB Has Done A Lot On Rates, Is In ‘Good Place’

- ECB’s Wunsch Says Rates In Good Place To Deliver Stable Inflation

- China Pushes Trump To Drop Curbs As It Dangles Investment Pledge

- European Parliament Seeks Faster Phaseout Of Russian Oil And Gas

- Russia Is Not Considering Diesel Export Ban For Producers, Ministry Says

- Meta, Pembina Near Deal To Build Massive Alberta AI Data Centre

- 3M Weighs Multibillion-Dollar Carve-Out In Industrials Arm

- Novo Plans To Make Obesity Pill Available Online Once Approved

- Airbus Had Record September With 73 Deliveries, Sources Say

- Trump Sets Sunday Night Deadline For Hamas To Agree To Gaza Plan

- EU Extends Russia Sanctions Over 'Hybrid Threat'

Eight OPEC+ countries are likely to further raise oil output on Sunday with the group’s leader Saudi Arabia pushing for a large increase to regain market share and Russia suggesting a more modest rise, four people with knowledge of OPEC+ talks said.

Russia and Saudi Arabia, the two biggest OPEC+ producers, have over the past years sometimes disagreed on the size of output rises but ultimately found a compromise. (Reuters – Continue Reading)

The Senate failed to pass government funding bills for the fourth time on Friday, leaving the shutdown in effect likely through the weekend with congressional leaders appearing to be at an impasse.

Ahead of Friday's vote, Senate Majority Leader John Thune stood firm on the Senate floor and signalled his party’s unwillingness to negotiate with Democrats over their demands in order to open the government back up.

"This shutdown needs to end sooner rather than later, and there's only one way out of it. Democrats need to vote for the clean, nonpartisan continuing resolution sitting right there," Thune said. "All it takes is one roll call, vote, the government's back open." (ABC – Continue Reading)

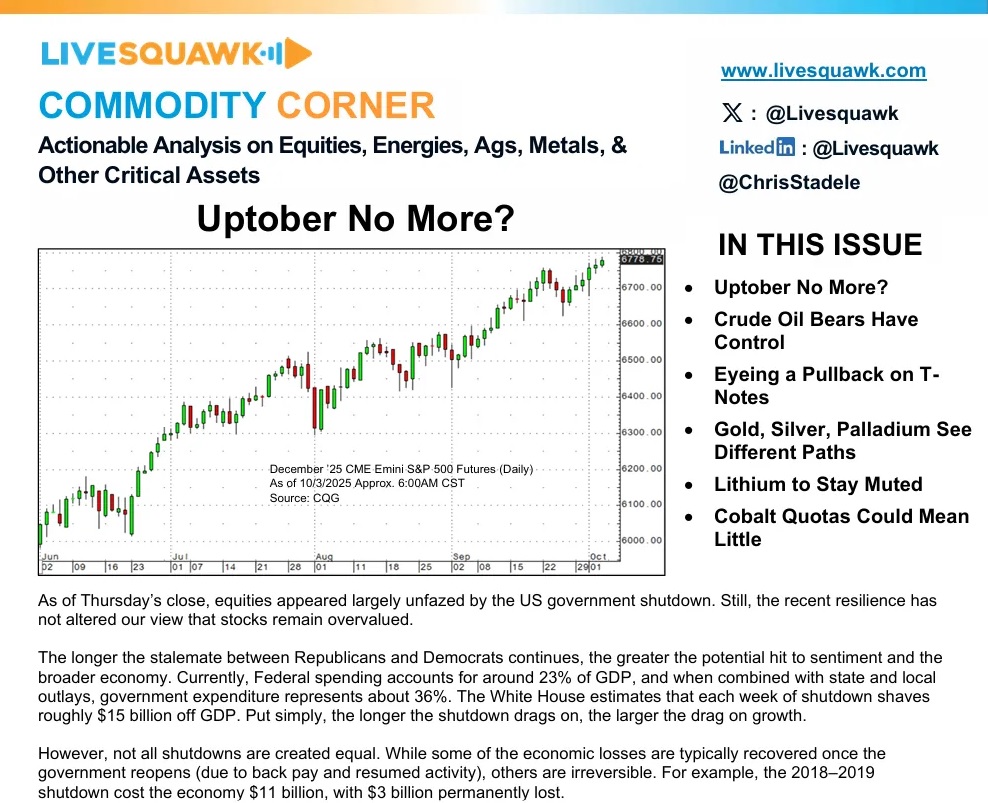

As of Thursday’s close, equities appeared largely unfazed by the US government shutdown. Still, the recent resilience has not altered our view that stocks remain overvalued.

The longer the stalemate between Republicans and Democrats continues, the greater the potential hit to sentiment and the broader economy. Currently, Federal spending accounts for around 23% of GDP, and when combined with state and local outlays, government expenditure represents about 36%. The White House estimates that each week of shutdown shaves roughly $15 billion off GDP. Put simply, the longer the shutdown drags on, the larger the drag on growth.

However, not all shutdowns are created equal. While some of the economic losses are typically recovered once the government reopens (due to back pay and resumed activity), others are irreversible. For example, the 2018–2019 shutdown cost the economy $11 billion, with $3 billion permanently lost. (LiveSquawk – Continue Reading)

Tesla and General Motors are leading the U.S. automotive industry this year in record domestic sales of all-electric vehicles, as consumers hurried to buy EVs before up to $7,500 in federal incentives for each purchase ended in September.

New data provided to CNBC from Motor Intelligence shows U.S. sales of EVs topped 1 million units through the first nine months of the year and set a new quarterly record of more than 438,000 units sold during the third quarter — achieving market share of 10.5% for the period.

That record market share is up from 7.4% during the second quarter and 7.6% during the first three months of the year, according to Motor Intelligence. Sales of all-electric models were estimated to be 1.3 million in 2024, with a roughly 8% market share. (CNBC – Continue Reading)

- US ISM Services Index Sep: 50.0 (est 51.7; prev 52.0)

- US S&P Global Services PMI Sep F: 54.2 (est 53.9; prev 53.9)

- US NY Fed GDP Nowcast Q3: 2.36% (prev 2.55%)

- Canada S&P Global Services PMI Sep F: 46.3 (prev 48.6)

- Eurozone PPI (M/M) Aug: -0.3% (est -0.1%; prev 0.4%; prevR 0.3%)

- Senate Fails Again To Advance Funding Bill, Shutdown Likely To Extend Into Next Week - ABC

- Trump Enlists Business To Push Dems On Shutdown - Axios

- Trump Admin. Freezes $2.1 Bln In Funds For Chicago Transit Projects – Guardian

- Fed’s Miran Says He’d Adjust Inflation View If Rents Turn Higher – BBG

- Fed’s Goolsbee ‘A Little Wary’ About Cutting Rates Too Quickly – CNBC

- Fed's Williams Says Central Banks Must Prepare For The Unexpected – RTRS

- Fed’s Jefferson Again Cautions On Risks To Inflation, Jobs Goals – BBG

- Fed’s Logan Urges Caution On Further Rate Cuts Amid Inflation Risks – Investing

- Canada PM Carney To Meet Trump In Washington On Tuesday – Baha

- Lagarde Says ECB Has Done A Lot On Rates, Is In ‘Good Place’ – BBG

- ECB Rates In Good Place To Deliver Stable Inflation, Wunsch Says – BBG

- BoE’s Bailey Warns Against Rolling Back Financial Regulation - RTRS

- New Bank Of Portugal Governor To Take Over On Monday - RTRS

- French Socialists Press Lecornu For Deeper Budget Concessions – BBG

- China Pushes Trump To Drop Curbs As It Dangles Investment Pledge - BBG

- Treasuries Gain On Week As Shutdown Leaves Market ‘Flying Blind’ – BBG

- Morgan Stanley Says Treasury Options See 10- To 29-Day Shutdown - BBG

- Citi Recommends Trade For Reflation, Fed Rate Hikes In 2026-2027 - BBG

- European Bond Yields Seek Direction Amid Dearth Of US Data – TV

- US Dollar On Track For Multi-Week Losses As Shutdown Weighs – CNBC

- EUR/USD Holds Modest Bid Amid US Shutdown And Mixed PMI Readings

- GBP/USD - Climbs To Intra-Day Peak On US ISM Services Miss - eFX

- AUD/USD Holds Near 0.6600 As Greenback Weakens On US Shutdown And Soft PMI Data - FXS

- ECB's Schnabel: Stablecoins Bring Risk - Baha

- UK Retail Investors Face Delays Before They Can Buy Regulated Crypto Assets - FT

- Rothschild Backs Coinbase While Flags Risks At Circle And Robinhood - Investing

- OPEC+ Set For Another Oil Hike As Saudi And Russia Debate Size – RTRS

- Oil Curve Watched By OPEC Is Tanking Just Before Supply Meeting - BBG

- European Parliament Seeks Faster Phaseout Of Russian Oil And Gas – BBG

- Russia Is Not Considering Diesel Export Ban For Producers, Ministry Says – TV

- India Looks For First US LPG Cargoes As Trade War Diverts Flows - BBG

- Gold Set For Seventh Straight Weekly Rise On US Shutdown Woes, Rate Cut Bets – CNBC

- Gold’s IPO Rush Is A Risky Twist On Its Rally - FT

- World Food Prices Dip As Falls In Sugar And Dairy Offset New High For Meat - RTRS

- TSX Rise On Tech Gains; Fed Rate Cut Bets Offset US Shutdown Concerns – RTRS

- Trump Considering Significant Tariff Relief For US Vehicle Production - RTRS

- Tesla, GM Lead Record US EV Sales This Year As Federal Incentives End – CNBC

- Detroit Carmakers Feud Over Trump’s Threatened Truck Tariffs – BBG

- Rivian Plans EV Door Redesign To Address Safety Concerns - BBG

- Amazon Loses Devices VP, CEO Advisory Member Days After Launches – Yahoo

- AI Venture Firm Gradient Ventures Spins Out Of Google - WSJ

- BlackRock Nears $40 Bln Data Center Deal In Bet On AI - BBG

- BlackRock’s GIP Wins Approval Of $6 Bln Allete Utility Deal - BBG

- Chevron Puts $2 Bln Colorado Pipeline Assets For Sale, Sources Say – RTRS

- Meta, Pembina Near Deal To Build Massive Alberta AI Data Centre – The Logic

- 3M Weighs Multibillion-Dollar Carve-Out In Industrials Arm - BBG

- FDIC Set To Jump Into Trump’s Debanking Fight With New Plan - BBG

- Novo Plans To Make Obesity Pill Available Online Once Approved – BBG

- Airbus Had Record September With 73 Deliveries, Sources Say - ZAWYA

- Huawei Used TSMC, Samsung, SK Hynix Components In Top AI Chips – BBG

- S&P 500 Ticks Higher In Choppy Trading, Heads For Winning Week – CNBC

- Trump Sets Sunday Night Deadline For Hamas To Agree To Gaza Plan – BBG

- EU Extends Russia Sanctions Over 'Hybrid Threat' - Baha

- Russia Reports 'Massive' Strike On Ukraine's Military Complex – Baha

- Russia Targets UK Military Satellites On Weekly Basis - BBC

- Beijing Blasts Mexico Over Protectionism, Threatens Retaliation Amid US Coercion – SCMP