- House Votes To End Trump's Tariffs On Canada As 6 Republicans Cross Aisle

- UK Economy Grew Less Than Forecast In Q4, Piling Pressure On Starmer

- BoE’s Breeden: Rate Cut Should Come Soon As Inflation Eases

- Makhlouf Says Next ECB Move Could Be Interest-Rate Cut Or Hike

- EU Kicks Off Bank Rules Consultation In Next Step Toward Reform

- Bank Of France Sees Sustained Economic Growth In Early 2026

- Global Oil Demand To Rise Less Than Expected In 2026, IEA Says

- China Bought Some Venezuelan Oil From The US, Wright Says

- Bombardier Q4 Revenue Rises On Higher Business Jet Deliveries

- PG&E Corp. Raised FY26 Adj. EPS Outlook; Q4 Adj. EPS Meets Estimates

- Italian Tax Police Search Amazon In New Tax Probe, Sources Say

- Novo Set To Make Wegovy Pill In Ireland For Markets Outside US

- Unilever Profit Rises Amid Strategic Shift

- Hermes' Sales Continue To Grow At Year-End

- SoftBank Swings To Profit, Boosted By Gain From OpenAI Investment

- Nissan Posts 44% Drop In Quarterly Operating Profit

- Maduro Is The 'Legitimate President' Of Venezuela, Acting Leader Says

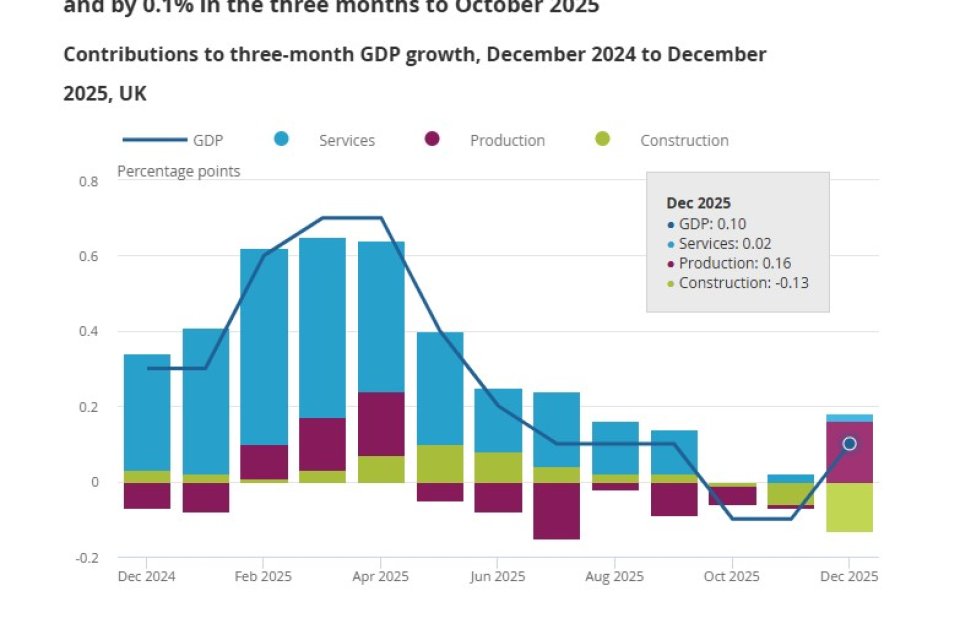

Preliminary data from the Office for National Statistics showed the UK economy recorded only modest expansion over the final three months of 2025.

In the three months to December, GDP rose 0.1%, matching the pace seen in Q3 but undershooting the 0.2% consensus estimate. Output was 1.0% higher than a year earlier, down from 1.2% in the previous quarter.

Liz McKeown, ONS director of economic statistics, said: “The often-dominant services sector showed no growth, with the main driver instead coming from manufacturing. Construction, meanwhile, registered its worst performance in more than four years.”

A breakdown of output showed that quarterly growth was driven by a 1.2% increase in production. The absence of any meaningful rebound in business investment was flagged as a concern by analysts, with government spending appearing to shoulder much of the burden. (LIveSquawk – Continue Reading)

In a closed-door meeting with Senate Republicans Wednesday, Treasury Secretary Scott Bessent agreed with lawmakers who suggested the Senate Banking Committee could investigate Federal Reserve Chair Jerome Powell, instead of the Justice Department, people in the room told Semafor.

One of the sources, a lawmaker, said they interpreted the exchange as “testing the waters” to see if the arrangement could get Sen. Thom Tillis, R-N.C., to lift his blockade on Fed nominees. (Semafor – Continue Reading)

The Trump administration has shelved a number of key tech security measures aimed at Beijing ahead of an April meeting between the two countries' presidents. The measures include a ban on China Telecom's U.S. operations and restrictions on sales of Chinese equipment for U.S. data centres, sources said.

The U.S. has also put on hold proposed bans on domestic sales of routers made by TP-Link and the U.S. internet business of China Unicom and China Mobile along with another measure that would bar sales of Chinese electric trucks and buses in the U.S., four people said, declining to be named. (Reuters – Continue Reading)

The Trump administration is dramatically expanding an effort to revoke U.S. citizenship for foreign-born Americans as it works to curb immigration, according to two people familiar with the plans.

Over the past several months, U.S. Citizenship and Immigration Services, the agency within the Department of Homeland Security that’s responsible for legal immigration, has been sending experts to its offices around the country or reassigning staff members to focus on whether some citizens processed through those offices could now be denaturalized, these people said.

The goal of emphasizing naturalized citizens is to supply the office of immigration litigation with 100 to 200 possible cases per month, one of the people familiar with the plans said. Such cases have typically been very rare, involving people who concealed criminal histories or previous human rights violations during their application processes. The New York Times first reported the quota. (NBC – Continue Reading)

- UK GDP (Q/Q) Q4 P: 0.1% (est 0.2%; prev 0.1%)

- UK Industrial Production (M/M) Dec: -0.9% (est 0.0%; prev 1.1%; prev R 1.3%)

- UK Index Of Services (M/M) Dec: 0.3% (est 0.1%; prev 0.3%; prev R 0.1%)

- UK Construction Output (M/M) Dec: -0.5% (est 0.5%; prev -1.3%; prev R -0.8%)

- UK Visible Trade Balance (GBP) Dec: -£22724M (est -£22288M; prev -£23711M)

- BoJ Yen-Index Feb-12: 74.90 (prev 74.17)

- House Votes To End Trump's Tariffs On Canada As Six Republicans Cross Aisle - BBG

- Fed's Miran Says There's Still A Variety Of Reasons To Cut Rates - BBG

- Republicans Suggest Senate, Not Justice Department, Investigate Powell - Semafor

- Democrats Eye Protests At Trump's State Of The Union – Axios

- Makhlouf Says Next ECB Move Could Be Interest-Rate Cut Or Hike - BBG

- ECB To Broaden Access To Euro Backstop, Board Member Says – RTRS

- POLL: ECB To Extend Its Longest Interest Rate Pause Since Below Zero Days – RTRS

- EU Kicks Off Bank Rules Consultation In Next Step Toward Reform – BBG

- UK Economy Grew Less Than Forecast In Q4, Piling Pressure On Starmer - BBG

- BoE’s Breeden: Rate Cut Should Come Soon As Inflation Eases – Business Live

- RICS: London's Property Market Showing Signs Of Life After Year-Long Slump - BBG

- Bank Of France Sees Sustained Economic Growth In Early 2026 - BBG

- Belgian Police Raid European Commission Over Sale Of Properties - FT

- RBA Open To Hike Again If Inflation Proves Sticky, Governor Says - BBG

- Mizuho Exec: BoJ Could Hike Rates As Early As March, Up To 3 Times In 2026 – RTRS

- China Confirms It’s Talking To US About Trump Visit - SCMP

- Moody's Ratings Affirms Korea's Aa2 Issuer Rating; Maintains Stable Outlook

- Treasury Yields Edge Lower As Investors Look Ahead To Key Inflation Report – CNBC

- Gilt Yields Fall After Weak UK GDP Data – WSJ

- UK Picks HSBC As Platform Provider For Its Digital Bond Pilot Issuance - RTRS

- Japan Investors Stay Wary Takaichi Will Spur Another Bond Crash – BBG

- Dollar Slips Lower And Heads For Weekly Loss; NFP Offers Little Support – Investing

- Hedge Funds Flipping To Bullish Bets On The Yen - BBG

- GBP/USD Holds Above 1.3600 Despite Grim UK Economic Data – FXS

- EUR/USD Picks Up From Lows As US Dollar's Rebound Loses Momentum – FXS

- Global Oil Demand To Rise Less Than Expected In 2026, IEA Says – RTRS

- China Bought Some Venezuelan Oil From The US, Wright Says - BBG

- Arconic Looks To Buy ~90 Million Pounds Of Aluminium In Spot Market In Q2 - BBG

- Gold May Climb To $6,300/Oz By Year-End, JPMorgan Private Bank Says - BBG

- China Lowers EU Dairy Tariffs In Final Ruling After 18-Month Probe – RTRS

- Bombardier Q4 Revenue Rises On Higher Business Jet Deliveries – RTRS

- PG&E Corp. Raised FY26 Adj. EPS Outlook; Q4 Adj. EPS Meets Estimates - RTT

- Pershing Square Takes Significant Stake In Meta - BBG

- Cisco Fell Postmarket After Adjusted Gross Margin Forecast Missed - BBG

- McDonald's US Sales Grew At Fastest Pace In More Than Two Years - BBG

- Italian Tax Police Search Amazon In New Tax Probe, Sources Say - RTRS

- Apple's Latest Attempt To Launch New Siri Runs Into Snags - BBG

- Blue Owl's Stack Adds To AI Debt Rush With $2.1 Billion Loan - BBG

- Private Companies Are Deferring Loan Payments At A Higher Rate - BBG

- Elon Musk Restructures xAI After Two Co-Founders Exit - BBG

- Jefferies Cuts Humana Target Price To $235 From $310 – Moomoo

- Unilever Profit Rises Amid Strategic Shift - WSJ

- Hermes' Sales Continue To Grow At Year-End - WSJ

- Schroders Agrees £9.9Bln Takeover By US Investment Manager Nuveen - FT

- Novo Set To Make Wegovy Pill In Ireland For Markets Outside US – BBG

- Sanofi Names Merck KGaA’s Garijo To Replace Hudson As CEO - WSJ

- Job Cuts Loom As BAT Plans To ‘Simplify’ And Boost Productivity - FT

- Strikes By German Pilot And Unions Force Lufthansa To Cancel Flights – Independent

- SoftBank Swings To Profit, Boosted By Gain From OpenAI Investment - FT

- Nissan Posts 44% Drop In Quarterly Operating Profit - RTRS