CAPITALISE ON NEWS THAT MOVES MARKETS

LiveSquawk Delivers News Fast So You Can Respond First

WHY LIVESQUAWK?

Audio News Broadcast

- Ultra-low latency audio news service (or squawk).

- Timely, sharp & pertinent commentary.

- Broadcasting 24 hours a day.

- Coverage of all the main asset classes.

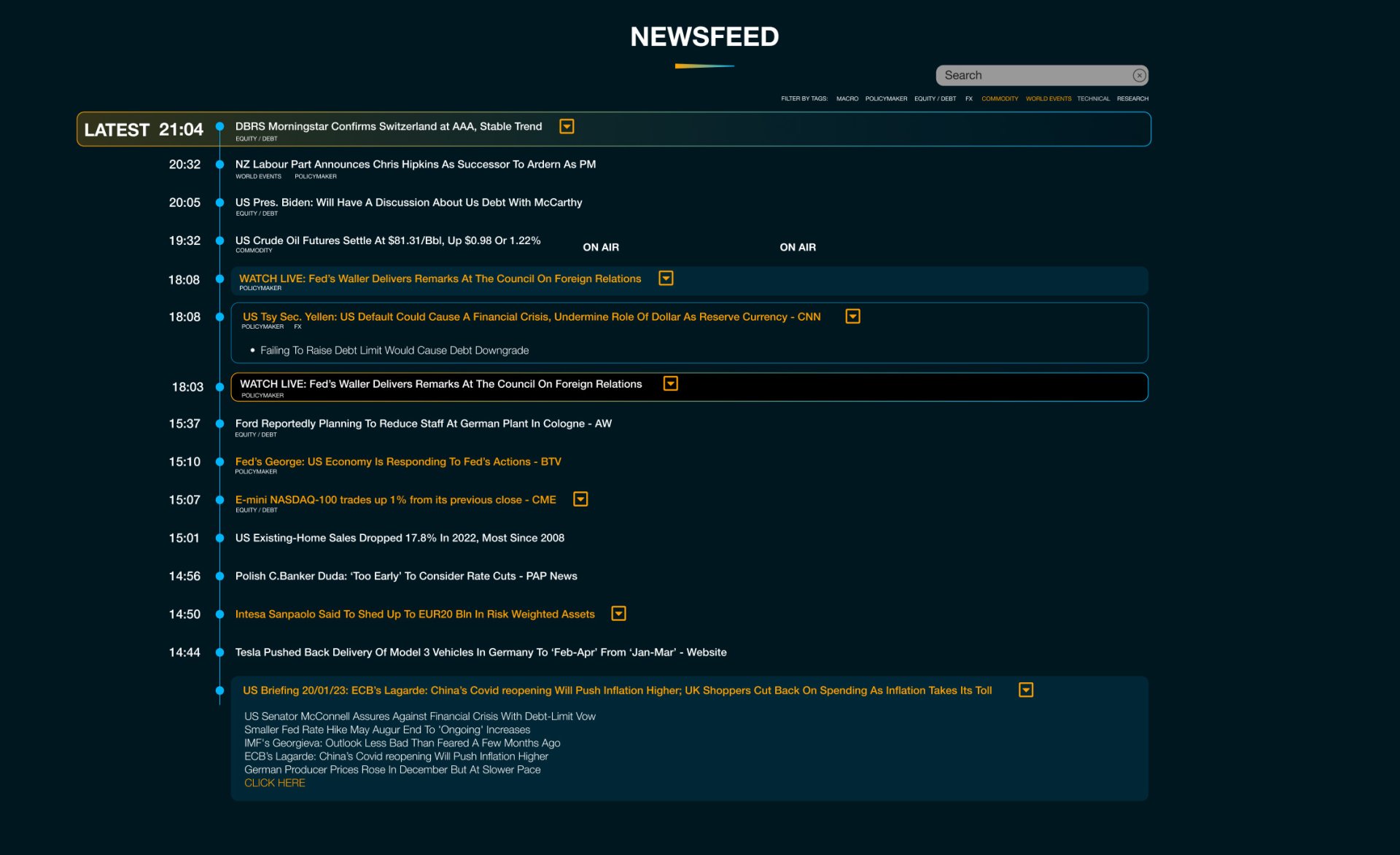

NEVER MISS A HEADLINE

- Live scrolling news headline feed.

- Filter the news that's important to you.

- Access data, key commentary, and speeches.

- All your financial news in one place.

in-house journalists & researchers

- We preview important economic data, major events & company earnings.

- Access Morning, Afternoon & Evening round-ups.

- Read top news stories & commentary.

- Utilise daily and weekly economic calendars.

WE Aggregate & Select

- Important investor commentary

- Bank desk research

- Summarise geopolitical events

- Key market analysis

OUR OFFERS

PAY MONTHLY - £275 / $350

The monthly subscription gives you peace of mind that you'll receive comprehensive coverage day or night.

PAY ANNUALLY - £3025 / $3850

A discounted single payment, renewed yearly.

Cancellation Policy: Cancel anytime before your contract renewal is processed and you will not be charged. Pro-rated refunds are not given on cancelled annual subscriptions.

FAQs

It depends on how busy of a news day it is. In general, we will try only to squawk something potentially market-moving.

Not as much as you think, especially compared to the cost of missing a key headline. £275 / $350 Monthly or £3025 / $3850 Annually

Of course. Cancel anytime before your contract renewal is processed and you will not be charged. Note that pro-rated refunds are not given on cancelled annual subscriptions.

We are a news aggregator and scrape news from across the web. We also employ journalists, as well as utilise our industry connections.

Our coverage spans all the major asset classes, geopolitical events and worldwide news.

Yes, you can filter the newsfeed. We tag our text headlines based on selected criteria such as Macro, Policymaker, Equity/Debt, FX, Commodity, World Events, Technical or Research.

TESTIMONIALS

An Essential Part of Trading Infrastructure

CEO and co-founder of TradeDay

The Team Quickly Processes Breaking News

MrTopStep joined forces with LiveSquawk over 8 years ago and is our main source for live and breaking news in the MrTopStep forum. They are the only source allowed to use our Market On Close (MIM) product live. The team's ability to process all the breaking noise and filter it down to market moving stories gives our members a heads up and an edge for adjusting positions.

Founder of MrTopStep

A Truly Invaluable Resource

"Integrating LiveSquawk into The Trading Pit has empowered our traders with real-time financial news, driving better decision-making and enhanced market performance. A truly invaluable resource for staying ahead."

CEO at TheTradingPit.com

LiveSquawk Has Made Me Plenty of Pips

“In this ever-changing world of news dissection and headlines coming from many different sources, like social media, where sometimes even the Bloomberg and Reuters of the world can be late to a breaking headline, LiveSquawk has made me (as well as others in our room) plenty of pips by being the fastest to a headline.”

MD at ForexFlow

TRUSTED BY 1200+ COMPANIES

Introducing LiveSquawk Market Talk Podcast

Join market veterans for deep-dive analysis ahead of major financial events that move markets.

From Non-Farm Payrolls to central bank decisions, our expert guests break down market positioning, potential trading opportunities, and global implications.

Get the critical insights you need to stay ahead of market-moving news. Brought to you by LiveSquawk, the trusted source for real-time financial news covering 120+ countries and all major asset classes.